|

Tax Time is rolling around, which confuses many of my clients. There is a lot of daunting terminology out there. I’m going to stick with stuff you actually need to know.

Disclosure: I’m not a CPA but I’ve learned some things through the years. Get ready to learn.

1099-MISC: A “1099-MISC” is for work you did as an independent worker or freelancer.

1099-INT: This reports interest income you’ve received from savings/CD/money market accounts. It also includes any interest you receive from bonds outside a retirement account. This income is taxed at your federal income tax bracket.

1099-DIV: If you are receiving dividends from an account outside a retirement account you must pay taxes. These tax rates can be more favorably.

As an aside, most people believe the long term capital gains rate to be 15%. It often times isn’t. If you are married and show less than $80,000 in income, the tax rate for long term capital gains is zero. If you add your social security plus your IRA withdrawals plus the capital gains and it totals less than $80,000- no capital gains tax.

1099-R: This is probably the most important forms to most of my clients. It reports how much money you distributed from your retirement accounts (IRA, 401k, etc.). It does not apply to Roth IRA’s.

Required Minimum Distributions (RMD’s): I get a tremendous number of questions on this subject. The IRS just raised the age at which time you need to start withdrawing money from your retirement accounts (from 70.5 to 72). The amount you need to remove depends on your age. At 72 the amount is around 4%. Do you need to worry about RMD’s? My clients don’t. By taking the 5% of their portfolio, they naturally satisfy the RMD.

Stretch IRA: When you pass your retirement accounts on to your heirs there is no need for them to cash in the account right away. This would trigger massive taxation. The IRS now gives them 10 years to spread the tax burden over time.

Standard deduction: The vast majority of you will utilize the standard deduction. If you are married you can deduct $24,800 from your income. Meaning- if you income is $100,000, you only have to pay taxes on $75,200 after the standard deduction. If you are single the number is $12,400.

The only time you would not use the standard deduction is in situations where you have several other deductions (mortgage interest, charitable giving, etc.). These are called itemized deductions. About 90% of the U.S. population just use the standard deduction.

For example, if your mortgage interest is $15,000 you do not get to deduct it from your taxes, as it is less than the standard deduction.

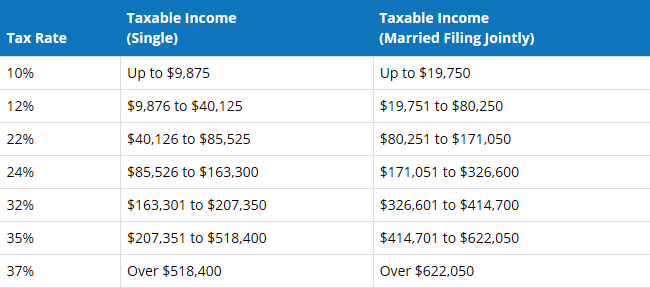

Progressive Taxation: I find some people can have difficulty with this concept. Below are the current tax rates:

This is where the confusion comes in. Looking at the table above, some people believe if they make one dollar over the 12% threshold they must pay 22% income tax on all their income. This is not how this works. Let’s say you are single and make $85,526.

The first $9,875 is taxed at 10%. From $9,875 to $40,125 you pay 12%. From $40,126 to $85,525 you pay 22%. So if you are one dollar over, you would only pay 24% on that one dollar.

Cost Basis: First look at how much you paid for a stock, bond, or real estate property. Then look at the selling price. You must pay taxes between the cost basis and the selling price. This does not apply to retirement accounts.

Estate Tax: In Florida this only applies to people worth over $10 million dollars. If you have that much please call for an appointment.

Gift Tax: This is also extremely misunderstood. Unless you are worth millions, you can gift as much as you want. The $15,000 rule does not apply. Give freely. The recipient does not have to pay taxes on it.

In addition, I always talk about how retirees are surprised at how little they pay in taxes once retired. I’m going to include the chart below so that you do a quick estimate of your monthly tax liability based on your monthly income.

Income is basically derived from Social Security + Pensions + 401k/IRA withdrawals. Of course this is not exact, but you get the idea.

| Married |

Married |

Single |

Single |

| Monthly Income |

Monthly Tax |

Monthly Income |

Monthly Tax |

| 0-5k |

$0 |

0-3K |

$0 |

| 5-6k |

$150 |

3-4K |

$150 |

| 6-7k |

$400 |

4-5k |

$350 |

| 7-8k |

$650 |

5-6k |

$550 |

| 8-9k |

$850 |

6-7k |

$750 |

| 9-10k |

$1100 |

7-8k |

$1000 |

| 10-11k |

$1300 |

8-9k |

$1300 |

| 11k+ |

Congratulations! |

10k+ |

Good Work! |

Be Blessed,

Dave

P.S. Please keep sharing. I’ve had a lot of new subscribers. Keep it up! Facebook seems to work best. |